This article was originally published by Tyler Durden at ZeroHedge.

Trump won in 2016, he also won in 2020 (but it was stolen from him thanks to 20 million “vapor” votes which magically failed to make a re-appearance in 2024), and he just won again in a landslide, not just the electoral but the popular vote as well… and boy are markets rocking!

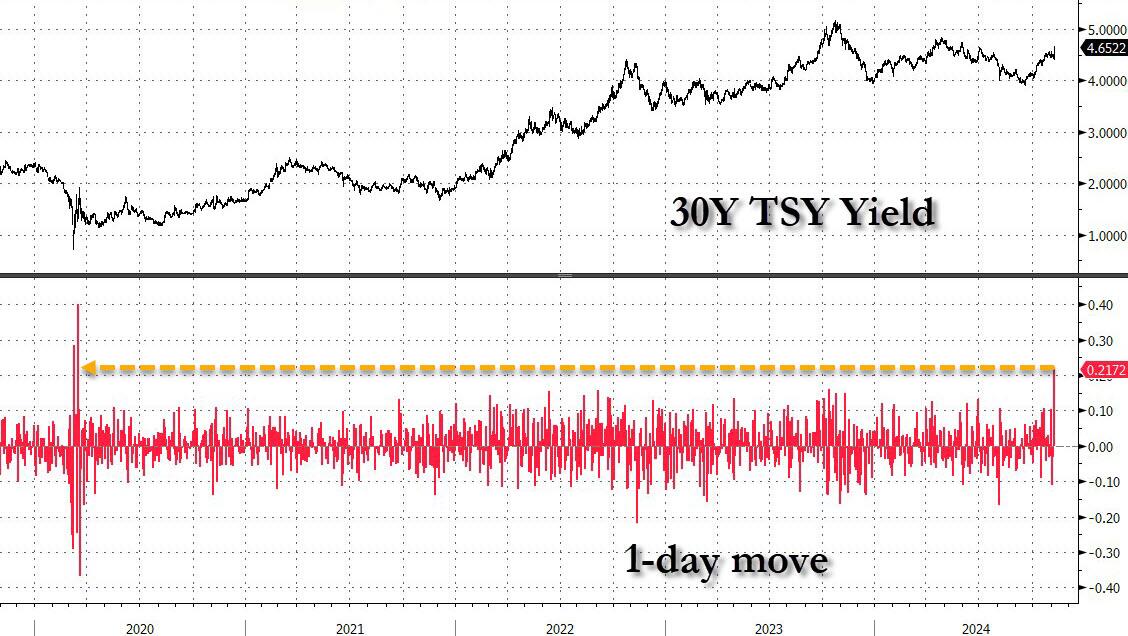

Donald Trump’s victory in the US presidential election has unleashed a shockwave in global markets as traders prepared for unprecedented policy and economic changes under the new administration. Trump’s political comeback sparked a surge in risk assets, sending 30-year Treasury yields and the dollar to their biggest gains since 2020…

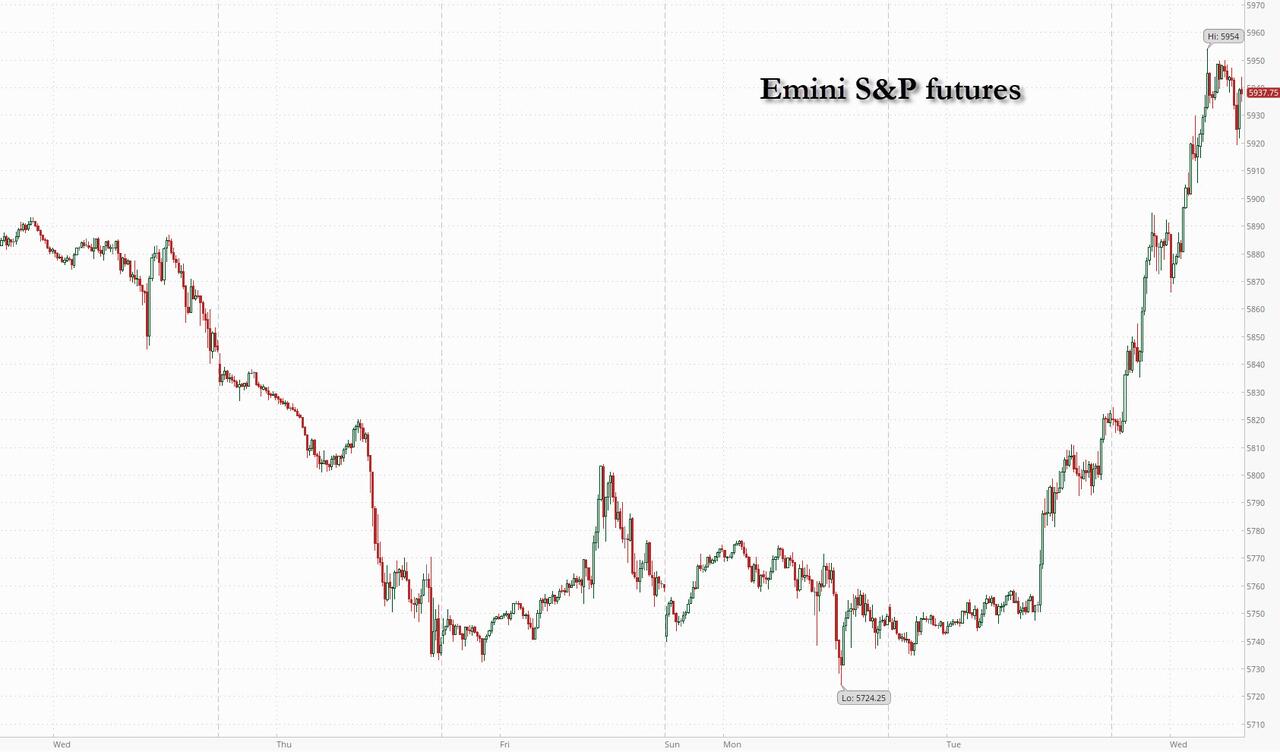

… Dow futures soared more than 1,300 points…

…. S&P 500 futures climbed 2.3%…

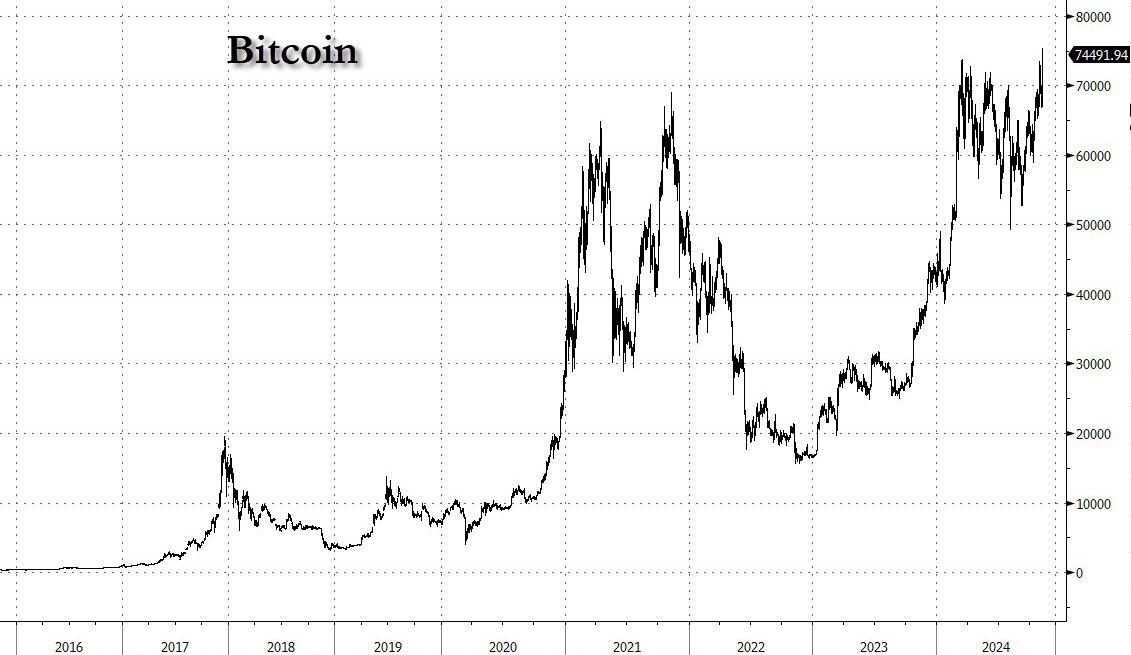

… and Bitcoin spiked to a record.

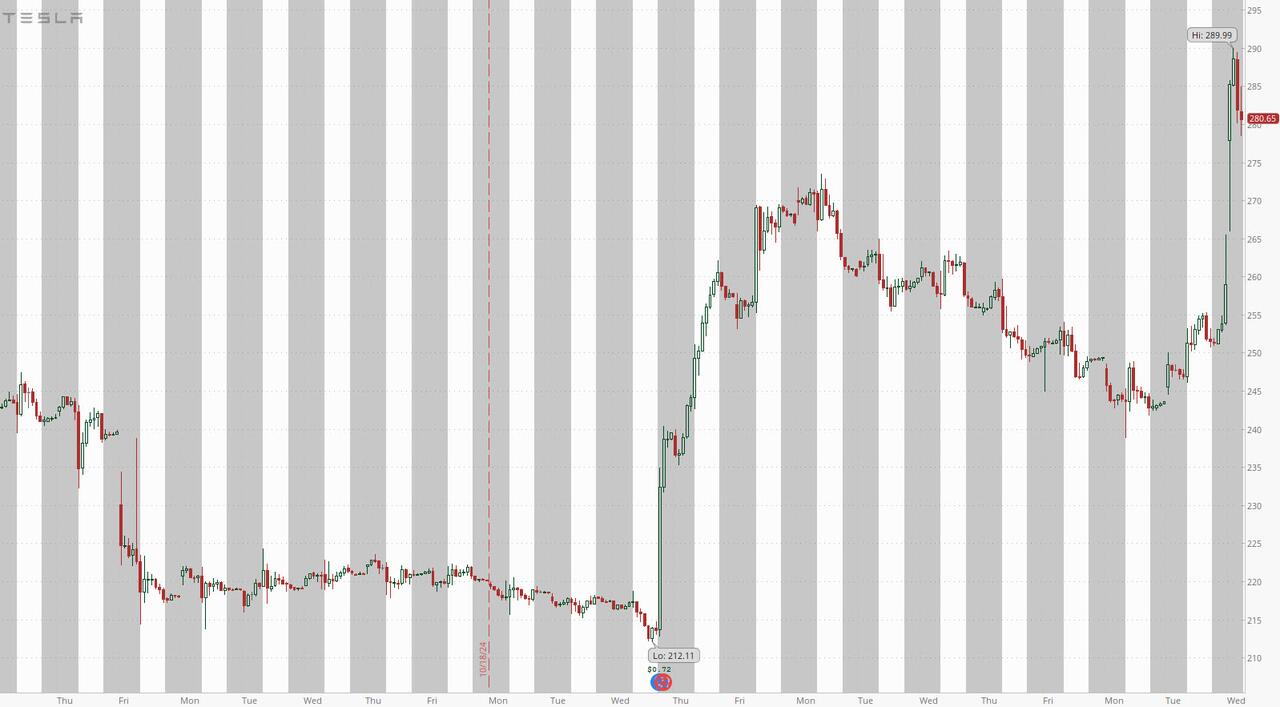

Tesla co-founded by Trump’s biggest backer Elon Musk, surged 15% in premarket trading.

From London to Tokyo, investors around the globe grappled with the far-reaching effects of a Trump presidency, which according to Bloomberg “is expected to bring steep tariffs on imported products, worsen trade tensions with China, and increase pressure on Europe to ramp up defense spending.” Apparently, it is also sending risk assets soaring. The Mexican peso – viewed as the anti-Trump trade due to his threats to flood Mexico’s economy with tariffs – fell the most in three months and the euro led losses among Group-of-10 currencies.

“We’ve been talking about this Trump trade for a while. The fairly aggressive market reaction shows that investors didn’t know what to put on, and now they know,” Marvin Loh, senior macro strategist at State Street Global Markets, told Bloomberg TV. “A lot of us will be asking which ones potentially have either a lot more to move or really do not yet reflect the type of administration.”

For those who missed it, here is a recap of what happened in the year’s biggest event:

- Presidency & Senate: Trump is projected to have secured the Presidency and the Senate. On the Presidency, the main updates came relatively early doors from the North Carolina, Pennsylvania, and Georgia swing states which all went in favor of Trump. As it stands, Trump has 277 electoral votes with Harris on 224 (270 required), with the count continuing. For the Senate, Rep. gained two seats pushing them to 51 (50 required) vs 42 for the Dems, as it stands.

- House: The House remains too close to call. Major updates which were expected from California in the last few hours haven’t been sufficient to skew the too-close-to-call races in the state. As it stands, Republicans are projected to have gained two seats taking their tally to 200 (218 required) while the Democrats are on 188, having lost two. While the race can’t yet be called, Decision Desk assigns a ~58% probability of a Rep. Senate; note, this is down from a 65% peak just after Pennsylvania was called in the Presidential race. Given how close the race is, it could be days or possibly weeks until we have an answer on the House.

This is how all major asset classes reacted:

- US equity futures boosted by the Trump presidency; ES +1.8%, NQ +1.7%, DJIA +2.0%, RTY +4.3%. Additionally, Trump-sensitive names (i.e. TSLA & DJT) are posting significant gains.

- European futures were sent lower by almost 1% initially, given the potential trade/growth ramifications; however, this move tempered significantly into the European session with benchmarks now firmer by c. 1%. Action that is potentially driven by enthusiasm elsewhere and perhaps also influenced by a particularly busy morning of earnings.

- APAC trade saw the Hang Seng close lower by just over 2%, while the Nikkei 225 closed higher by 2.2% (benefitting from JPY action).

- For Fixed, USTs under marked pressure with the curve steepening though we await details on the House to see if this narrative flips into flattening; USTs at a contract low. The probability of a 25bps cut on Thursday’s FOMC remains essentially fully priced.

- EGBs diverge from this and are bid, with yields lower across the European curve as markets price increasing odds of frontloading action from monetary authorities; US-Ger. 10yr yield spread above 200bps (c. 195bps on Tue.). Focus also on the House, as that will influence the degree of widening.

- FX sees the DXY bid, the largest jump since March 2020. EUR lags given the trade risk and potential for monetary frontloading, and AUD & NZD hit on China exposure. JPY pressured given the potential for tighter Fed policy.

- Commodities has Crude weighed on by the USD and also “drill baby, drill” language coming to mind in terms of potential Trump-driven supply increases from the US. Gold is softer and base metals are particularly dented, awaiting updates on China stimulus which could be much higher under a Trump US presidency.

- Crypto saw BTC hit a record high, though has faded from this slightly and seemingly tracking the House odds to a degree.

Equities also reflected expectations that Trump would loosen financial regulation, embrace crypto, and support fossil fuel producers. JPMorgan and Bank of America shares advanced in early trading. Tilray, a cannabis company, sank 10% after Florida voters rejected a ballot measure to legalize recreational marijuana. Elsewhere in the premarket:

- Prison operators rose, with Trump seen as having a harder stance on the immigration issue. GEO Group (GEO) +22%, CoreCivic (CXW) +18%

- Crypto-related stocks gain with Bitcoin, which is viewed by many as a so-called Trump trade because Trump embraced digital assets during his campaign after a major push by the industry. Marathon Digital (MARA) +9%, Riot Platforms (RIOT) +10%

- In the auto sector, Tesla (TSLA) soars 11% as investors wager the carmaker run by Elon Musk will be a major beneficiary of Trump’s return to the White House. Meanwhile, Ford (F) +2% and GM (GM) +2%. Other stocks in the electric vehicle sector were falling, given Trump’s pledge to entirely reverse Biden’s EV policy

- Rivian Automotive (RIVN) -3%

- US health insurers focused on the Medicare market jumped on the expectation that the second Trump administration would pay higher rates to companies that provide private versions of the US health program for seniors. UnitedHealth (UNH) +7%, Humana (HUM) +9%

Some other notable premarket movers:

- Bigbear.ai (BBAI) slides 6% after the AI software company reported revenue for the 3Q that missed the average analyst estimate.

- Coupang (CPNG) dropped 6% after the e-commerce company reported third-quarter net sales that fell short of estimates. Morgan Stanley noted a step-up in technology spending, which it said was not expected by the market.

- Exact Sciences (EXAS) tumbled 22% as the colon cancer test maker cut guidance.

- Qualys (QLYS) jumped 20% after the information-security company’s 3Qearnings beat estimates and it raised its outlook for the year.

- Super Micro Computer (SMCI) plunges 15% after the company’s 2Q sales forecast fell short of expectations. The troubled server maker said it couldn’t predict when it would file official financial statements for the previous fiscal year.

Goldman’s trading desk said a Republican sweep may push the S&P 500 up by 3%, while moves would be half as much in the event of a divided government. A Morgan Stanley note said risk-taking appetite may dip in the event of a Republican sweep as fiscal concerns fuel yields, but if bond markets take it in their stride the likes of growth-sensitive cyclical stocks would rise.

We will have much more to say on the kneejerk reactions, but here are some more hot takes from Wall Street:

- Anastasia Amoroso at iCapital: We have a new investment regime most likely for the next four years or at least the next two years until the next midterm election. This means you can commit to some of those trades. The reason why small caps are rallying is because they are more sensitive to the republican majority and that is helping sentiment, domestic orientation, and potential for lower taxes.

- Justin Onuekwusi at St. James’s Place: There is potential for higher short-term volatility in bond markets in the aftermath of the election. We think this is particularly likely around US Treasuries as sentiment adjusts to the result. Possible higher inflation may also cause yields for long-term bonds to rise higher than short-term bonds. This is sometimes seen as a signal for the start of a strong economic period but can also indicate a time of higher interest rates.

- Charlotte Daughtrey at Federated Hermes: Trump’s “proposed tariffs may be reflationary. This may impact the pace of rate cuts or perhaps push them back into a rate hiking cycle, something they are keen to avoid.”

- Mohit Kumar at Jefferies: We see a continuation of the US equities rally. Our view has been that a number of investors are sitting on the sidelines and waiting for election uncertainty to be out of the way. Assuming a clean election result, with Trump policies largely considered positive for the market, a growth picture that is doing fine, and a Fed that is ready to cut rates, we see further upside in US equities. We also expect US equities to continue to outperform Europe and global indexes.

- Samy Chaar at Lombard Odier: The race for the House of Representatives will determine whether campaign pledges can be fully implemented. The question of tariffs is key for global trade and the Fed’s easing prospects.

- James Demmert at Main Street Research: Investors should look past the election and focus on the fundamentals of what drives markets. The economy and earnings continue to be better than expected, most stocks are reasonably priced and the Fed is in an accommodative mode and is expected to cut interest rates again this week. There is an excellent backdrop for stocks right now.

In Europe, stock gains have faded slightly as investors contemplate the risk of increased potential trade protectionism by a Trump administration. The Stoxx 600 is up 1.2% with health care and travel shares leading gains, while utilities and automobile sectors were the biggest laggards. Here are the biggest movers on Wednesday:

- Securitas gained as much as 11%, to the highest since May 2019, after the Stockholm-listed security services firm delivered results ahead of expectations in the third quarter

- Novo Nordisk shares rose as much as 8.9%, the most in roughly 8 months after the Danish drugmaker reported Wegovy sales for the third quarter that beat estimates

- Zealand Pharma shares gained as much as 7.6% after the Danish biotech company said moderate doses of its experimental weight-loss drug helped patients pare pounds with less nausea than some other next-generation contenders

- Wise shares jumped as much as 8.2% after the money transfer platform operator reported an underlying profit for the first half that was well ahead of expectations thanks to a better gross margin and lower operating costs

- Credit Agricole falls as much as 5.7%, the most since August, with analysts describing the French lender’s 3Q print as “slightly underwhelming,” with a miss on revenues, weighed down by lagging momentum in the insurance arm

- EDP Renovaveis shares fell as much as 8.4% to €11.58 and traded 7.6% lower as of 8:14 a.m. in Lisbon after the renewable energy co. reported a 53% drop in nine-month net income

- Siemens Healthineers shares jumped as much as 8.9%, the most since February 2023, after the German medical technology company reported fourth-quarter results that Stifel said were “much better than feared”

- BBVA shares dropped 5.6% in Madrid trading as Donald Trump closed in on a US election victory, with Barclays analysts earlier flagging that such an outcome would impact the bank’s Mexican business

- BMW shares fell as much as 7% after the German carmaker’s profit margin dropped to a four-year low due to a costly recall and weak China demand. Analysts highlight an “un-BMW” miss on free cash flow

- Commerzbank AG shares declined as much as 2.6% as higher-than-expected provisions and what analysts see as downside risk to 2025 net interest income overshadowed better-than-expected profit in the third quarter

In FX, the Bloomberg Dollar Spot Index is up 1.4%, with the greenback logging its largest gain against the euro in the G-10 space. The Mexican peso is one of the biggest losers overall with a 2.6% drop.

In rates, treasuries lost out, with US 10-year yields jumping 17 bps to 4.44% and the 2s10s curve steepening. Traders also pared Fed interest-rate cut bets while amping up their bets of European rate reductions, pricing in a faster pace of easing by the ECB and BOE to the benefit of bunds and gilts.

In commodities, oil prices decline, with WTI falling 1.3% to $71 a barrel. Spot gold drops $24 to around $2,720/oz. Bitcoin soared 7% to a record high.

To the day ahead now, data releases include German factory orders for September, and the final services and composite PMIs for October in the Euro Area. From central banks, we’ll hear from ECB President Lagarde, Vice President de Guindos, and the ECB’s Escriva, Vujcic, and Villeroy.

Market Snapshot

- S&P 500 futures up 2.2% to 5,940.00

- STOXX Europe 600 up 1.5% to 517.16

- MXAP down 0.2% to 187.54

- MXAPJ down 0.7% to 597.31

- Nikkei up 2.6% to 39,480.67

- Topix up 1.9% to 2,715.92

- Hang Seng Index down 2.2% to 20,538.38

- Shanghai Composite little changed at 3,383.81

- Sensex up 1.1% to 80,384.52

- Australia S&P/ASX 200 up 0.8% to 8,199.55

- Kospi down 0.5% to 2,563.51

- German 10Y yield down 4.6 bps at 2.38%

- Euro down 1.5% to $1.0761

- Brent Futures down 1.9% to $74.06/bbl

- Gold spot down 0.8% to $2,721.04

- US Dollar Index up 1.37% to 104.84

Top Overnight News

- Donald Trump won the presidential election after securing key swing states including Pennsylvania and Wisconsin. The GOP flipped Senate seats in Ohio and West Virginia to take control of the chamber. Trump said America has given him an “unprecedented” mandate. BBG

- BOJ minutes suggest central bank officials saw the economy making further progress, laying the groundwork for additional policy tightening. Reuters

- Some Asian monetary authorities are already moving to guard their currencies as US election-related volatility fuels a surge in the dollar. So far, there have been signals from China, India and Indonesia. BBG

- China’s central bank chief pledged to maintain an accommodative monetary policy stance and to double down on countercyclical adjustments to support the country’s economic growth. BBG

- Germany’s factory orders for Sept came in ahead of expectations at +4.2% M/M (vs. the Street +1.5%). WSJ

- US crude inventories rose by 3.1 million barrels last week, the API is said to have reported. That would take total holdings to the highest in almost three months if confirmed by the EIA today. Fuel supplies declined. BBG

- Novo Nordisk stock rose after Wegovy sales beat expectations last quarter, a potential relief for investors after Lilly’s disappointing obesity drug sales last week. BBG

- The Mexican peso led a slide in emerging market currencies. Ukraine’s dollar-denominated sovereign bonds jumped on expectations that the war with Russia will end quickly, as Trump has previously vowed. BBG

- Tesla soared premarket as investors wagered it’ll benefit from Elon Musk’s all-in bet on Trump. JPMorgan, BofA, Wells Fargo, and Citi shares all gained more than 6%. Trump Media leapt. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly followed suit to the risk on performance on Wall St as participants digested the US Presidential Election results where Trump is leading so far, and betting markets boosted their pricing of the former President returning to the White House. ASX 200 was lifted with outperformance in tech, consumer discretionary, and financials leading the gains seen in all sectors. Nikkei 225 surged above the 39,000 level with the momentum propelled by a weaker currency. Hang Seng and Shanghai Comp lagged with the Hong Kong benchmark the worst hit as tech was pressured amid the increased tariff threat for Chinese companies, while the mainland traded indecisively as prospects of looming fiscal stimulus offset the tariff threat.

Top Asian News

- Chinese Premier Li said in a meeting with Malaysia’s PM that the sides should push forward flagship railway and industrial development projects, while he added that both should look into emerging areas and new areas for potential cooperation, according to Xinhua.

- BoJ September meeting minutes stated that members shared the view BoJ will continue to raise interest rates if its economic and price forecasts are met, while members agreed that the BoJ must scrutinize market developments and the overseas economic outlook for the time being as markets remain unstable and many members said BoJ must scrutinize not just market moves but the factors behind their volatility such as US and overseas economic developments. Furthermore, a few members said the BoJ can afford to spend time scrutinizing the impact of overseas and market developments on Japan’s economy and prices, while one member said the BoJ should hold off on raising rates until global and market uncertainties diminish and a member also said it is undesirable to change the policy rate level now as financial and economic uncertainties are high, although one member said there could be times when raising rates would be appropriate even when markets are unstable.

- Japan’s Chief Cabinet Secretary Hayashi said it’s important for currencies to move in a stable manner reflecting fundamentals. Intend to watch closely on FX moves, including speculative moves, with a higher sense of urgency. Will do utmost in managing economic and fiscal policy while working closely with the BoJ.

- UMC (UMC, 2303 TW) October (TWD): Net Sales 21.3bln (prev. 19.19bln), +11.36% Y/Y.

- China’s Foreign Ministry says China will continue to work with the US on the basis of ‘mutual respect’. China’s policy towards the US is consistent.

- Chinese President Xi has urged Chinese officials again to meet annual economic targets, according to Bloomberg.

European bourses, Stoxx 600 (+1.7%) opened on a strong footing and continue to edge higher, with Presidential Candidate Trump poised to win the election. Indices have dipped off best levels in recent trade. Note, that European futures were lower by as much as 1% pre-open, before picking up given the US enthusiasm. European sectors hold a strong positive bias, with only Utilities and Autos trading in the red; the latter sensitive to potential tariff updates. Healthcare tops the pack, buoyed by gains in Novo Nordisk, post-earnings. US Equity Futures (ES 2.1%, NQ +1.7%, RTY +5.5%) are entirely in the green, with the “Trump Trade” very much in full swing, with the Republican nominee on the cusp of a historic victory. As a result, the economy-linked RTY is the clear outperformer today. US pre-market movers include; Tesla (+12.9%), Trump Media (+38.5%), Exxon (+2.9%), Morgan Stanley (+5.9%), JD.Com (-4.1%)

Top European News

- UK think tank NIESR forecasts the BoE cutting rates this week and to deliver three more cuts in 2025, while it sees the Bank Rate at 3.25% in 2026.

FX

- Hefty gains for the Dollar index which has seen its largest jump since March 2020 on the Trump trade as the former president is set for another four years in office. Eyes remain on the Congress configuration as the Senate has been called for Republicans whilst the House remains closed and could take days to be called. DXY surged from a 103.35 intraday low to a 105.31 peak this morning; the index has pulled back to current levels of 104.90.

- Sizeable downside for the EUR as a function of broader USD strength coupled with the potential ramifications of Trump’s trade agenda on EZ growth. Elsewhere, revisions higher to Final EZ PMI Services and Composite metrics were unsurprisingly overshadowed by the US election. EUR/USD slipped from a 1.0937 intraday high to a low of 1.0704 before coming off worst levels.

- GBP is softer but among the mid-table G10 performers with price action solely driven by the USD strength, with traders now looking ahead to tomorrow’s BoE whereby a 25bps to the Bank Rate is widely expected; attention for that remains on forward guidance, given the net-hawkish budget implications.

- JPY is among the G10 underperformers as the Japanese currency is hit by a surge in US yields, whilst desks also argue the JPY could act as a proxy to Asian FX about to be hit by another trade war. USD/JPY surged from a 151.31 low to a 154.38 intraday peak before stabilizing around 154.00.

- Antipodeans are lower intraday but among the “better” G10 performers after suffering during APAC hours. The high-beta statuses cushion losses against the backdrop of a solid “risk-on” session thus far, with surges seen across equities. Antipodeans also look ahead to the Chinese fiscal announcement which was expected to be contingent on the next US President.

- CNH is among the EM FX losers as Trump 2.0 is almost certainly likely to spark trade friction with China. That being said, Chinese markets eagerly await the touted fiscal stimulus package from the NPC Standing Committee.

- PBoC set the USD/CNY mid-point at 7.0993 vs exp. 7.1011 (prev. 7.1016).

- China’s major state-owned banks were seen selling dollars in the offshore FX market to prevent rapid yuan depreciation, according to Reuters sources.

- Citi has added a short position on the MXN vs the ZAR, following the US election result.

Fixed Income

- USTs are pressured, with Trump set to return as President with control of the Senate and a projected ~60% chance of having House control as well; though the House remains far too close to call, and as it stands, we may not have an answer for several days or even weeks. The Trump Trade is in full swing for bonds with USTs at a contract low of 109-07, vs a 110-21+ initial high print for the session. However, if this narrative moves to a Trump ex-Congress (i.e. Rep. Senate but a Dem. House) government, then we may see a fading of the steepening in favor of flattening.

- Bunds are bolstered by the Trump victory. The narrative for EGBs is one of a lower yield environment given the potential headwind to Europe from an America-first and tariff-heavy US administration and the expected frontloading of monetary stimulus to offset growth headwinds. Bunds off a 132.22 peak to a current 131.82, with the UST-Bund 10-year yield spread having widened to in excess of 200bps vs the 194bps peak on Tuesday. There was little impact following today’s 15- and 30-yr auctions.

- Gilts were initially somewhat unreactive to the election, seemingly caught between the bullish lead from EGBs and the bearish one from USTs as the arguments for those moves don’t neatly apply to the UK, which remains focused on its own fiscal issues/implications ahead of Thursday’s BoE.

- Germany sells EUR 0.409bln vs exp. 0.5bln 2.50% 2046 Bund & EUR 0.805bln vs exp. EUR 1bln 2.60% 2041 Bund Auction

Commodities

- A soft session for the crude complex thus far as Trump looks set to win the US presidential race, with a stronger Dollar pressuring the complex alongside Trump’s drilling policies raising the prospect of higher US supply. Brent’Jan currently holds around USD 74.40/bbl.

- Precious metals trade lower across the board with the complex hit by the broader Dollar strength on the Trump trade. XAU/USD fell from USD 2,749.78/oz to a current low of USD 2,701.42/oz.

- Hefty losses across most industrial metals given the prospects of trade wars under Trump 2.0. That being said, the sectors will still be eyeing the NPC Standing Committee’s announcement for fiscal stimulus. 3M LME copper trades towards the bottom of a USD 9,513.00-9,708.00/oz.

- NHC shows that Rafael is now a Hurricane; earlier guidance was for it to intensify into one shortly.

- China will step up efforts to support domestic exploration of Lithium, Cobalt, and Nickel resources and bolster national resource security under the plan.

Geopolitics

- “IDF Spokesperson: Warnings were activated in a number of areas in northern and central Israel following launches crossing from Lebanon”, according to N12.

- Iran’s Revolutionary Guards deputy commander said Tehran does not rule out a US-Israel pre-emptive strike to prevent Iranian retaliation against Israel, via ISNA; said Iran and “resistance front are ready for confrontation”.

- US official said the surprising decision by Israeli PM Netanyahu to fire Defense Minister Gallant is concerning, especially in the middle of two wars and as Israel prepares to defend against a potential attack from Iran, while the official said they have real questions about the reasons for Gallant’s firing and about what is driving the decision, according to Kann’s Stein.

US Event Calendar

- 07:00: Nov. MBA Mortgage Applications, prior -0.1%

DB’s Jim Reid concludes the overnight wrap

It’s been a big night with Mr Trump looking set to become just the second President to serve non-consecutive terms in history, and the first for well over a hundred years, after Grover Cleveland in the late-19th century. So a likely remarkable political comeback after an approval rating in the low 30 percent range when he left office in January 2021.

As we type, the New York Times needle, which is a well respected forecasting gauge has Trump with a 92% chance of victory. Polymarket.com is pricing it at 97%. Of the battleground states, only North Carolina and Georgia have so far been called by the media in favour of Trump with the other 5 with a probability of 64-80% going to Trump. The potential tipping point state of Pennsylvania has a 79% probability.

In terms of Congress, the House will be the key to whether there is a “red sweep”. Here we may not have more clarity until later in the day or even later in the week. The seats have all gone as expected so far which suggests it could be very close. The perception is that the popular vote may be the best proxy for this and here the NYT needle’s estimate suggests Trump is likely to win by 1pp, albeit with a 3pp margin for error on either side. If Trump does win the popular vote it will be the first time in his three election runs. Polymarket has swung a lot in the last hour but the House going Republican is at 64% as I finish typing at 5:45 am.

So it seems the biggest market debate will now be between a Trump red sweep and a Trump divided government where the House stays with the Democrats.

As a reminder, control of the House will be important for policy expectations and markets. While our strategists have seen a Trump victory as positive for the dollar (see here), not least given significant presidential authority on trade policy, congressional control will be important in many areas, especially fiscal policy. Our economists have previously viewed a Republican sweep as having the most upside in terms of fiscal easing (see here), with potential corresponding upside for the Fed terminal rate. Our strategists also saw a red sweep scenario as having the clearest upside for Treasury yields.

The market reaction so far is probably going as you would expect given the results. The 10yr Treasury yield is up +12bps to 4.39%, the dollar index is +1.26% higher, with the euro falling -1.27% against the greenback. That comes after the dollar index fell -0.45% yesterday, starting the week with its worst two-day run (-0.82%) since August. Other Trump trades benefiting include Bitcoin rising +7.26%. S&P (+1.02%) and Nasdaq +(0.84%) futures are both up as I type. Red sweep trades are off their highs with the direction of the House being in a little doubt. One thing to consider is that if there is a split Congress, you could argue that tariff policy becomes the priority assuming Trump wins, as he won’t be able to get his tax policy through without negotiations.

European equity futures are -0.59% lower and European bond futures are a lot flatter than US bonds as markets wake up to the implications of Trump’s likely tariff policies. If the results continue to move in this direction, then the prospects of the ECB being forced to move faster will increase. Nothing happens in isolation though, and there is risk of an early German election given events over the last few days which our economists have discussed here. This could have some implications for fiscal policy. Elsewhere China’s NPC standing committee may announce more clarity on fiscal policy when the meeting ends on Friday. It’s possible they have been waiting for the results of the US election to calibrate things. So lots of moving parts.

In Asia, the Nikkei is outperforming with a gain of +1.87%, and the S&P/ASX 200 is also up by +0.85%. Conversely, the Hang Seng Tech Index is down by -3.03%, followed by the Hang Seng, which has dropped -2.61% and the KOSPI (-0.93%). Mainland Chinese stocks are fairly flat.

Yesterday might feel like ancient history now, but before we knew the direction of the likely election result, markets saw a strong risk-on move thanks to an upside surprise in the ISM services index for October. It rose to its highest level since July 2022, coming in at 56.0 (vs. 53.8 expected), and the details were also very positive. For instance, the employment component was back at an expansionary 53.0, marking its highest level since August 2023. And even though there was a modest downtick in new orders to 57.4, it was still the second-strongest print since February 2023.

That release continued the run of positive data surprises from the US recently, and it led investors to pare back their expectations for rate cuts over the months ahead. The rate priced in for the Fed’s December 2025 meeting was up +3.7bps yesterday to 3.66%, taking pricing back to roughly where it was before the summer market turmoil. However, the rise in rates proved fleeting on the long end of the curve. 10-year Treasury yields ended the day -1.3bps lower at 4.27%, despite trading +8bps intra-day early on, with the reversal helped by a decent 10-year auction. Obviously, all this has changed this morning.

Speaking of bonds selling off, yesterday saw UK gilts continue to underperform amidst weak demand at a 10-year auction. That follows last week’s announcement of noticeably higher borrowing in the budget, and it meant the spread of 10-year gilt yields over bunds widened by another +4.0bps to 211bps. That’s the biggest gap since Liz Truss was still PM back in October 2022, having risen by nearly 50bps since mid-September. In absolute terms, the 10-year gilt yield was up +7.2bps to a one-year high of 4.53%. Elsewhere in Europe, the selloff also saw yields on 10-year bunds (+3.3bps) hit a three-month high of 2.42%.

US equities showed no signs of pre-election jitters, as the S&P 500 (+1.23%) posted its strongest gain since September to close less than 1.5pp from its record high. That was supported by the upbeat data, and the Atlanta Fed’s GDPNow estimate for Q4 stood at 2.38% after yesterday’s releases. So there’s little sign that the strong growth of late is easing, which has continued to boost risk assets. The megacap tech stocks led the way, with the Magnificent 7 up +1.76%, with Nvidia (+2.84%) overtaking Apple (+0.64%) as the world’s most valuable company. The tech advance was supported by software platform provider Palantir Technologies (+23.47%) after it reported strong AI-related demand. But the gains were broad-based with all 24 industry groups within the S&P 500 higher on the day and the small-cap Russell 2000 (+1.88%) outperforming. European markets were fairly subdued, and the STOXX 600 was only up +0.06%.

To the day ahead now, data releases include German factory orders for September, and the final services and composite PMIs for October in the Euro Area. From central banks, we’ll hear from ECB President Lagarde, Vice President de Guindos, and the ECB’s Escriva, Vujcic, and Villeroy.

Read the full article here